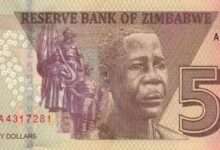

RBZ Set To Introduce New $10 & $20 Bond Notes

FINANCE minister Mthuli Ncube has hinted to Parliament that he will be introducing higher denominations of $10 and $20 notes in the near future.

Ncube revealed this on Thursday in the Senate while responding to a question by Masvingo Senator Tichinani Mavetera (MDC Alliance) on the practical steps that he was taking to deal with unscrupulous practices, whereby some businesses are demanding payment in United States dollars.

Ncube said to deal with re-dollarisation, he would first ensure that more cash, in terms of Zimbabwean dollars, was pumped into the system.

“In the last month, we put in cash to the tune of $110 million and we said that in the next six months, we will continue to put in more cash,” Ncube said.

“What we will do going forward is to also increase the size of the denomination. You can imagine that if it is $2 or $5 notes, you have to pack quite a lot of them into the automated teller machines to make withdrawals and so high denominations like $10 or $20 notes are needed going forward and we will be doing that,” he said.

Ncube said they were releasing the new $2 and $5 notes in dribs and drabs to avoid inflation.

“If we put in all the cash that is needed in one moment, it will increase inflation sharply, but also, it may impact the exchange rate and even cause more inflation and so we are using a strategy called a swap, where we are swapping RTGS [real time gross settlement] balances for cash with the bank,” he said.

“What that does is it helps you pump cash into the economy, but without increasing the aggregate amount of cash in circulation.”

The Finance minister said at the moment, the cash in circulation in Zimbabwe, as a percentage of the stock of cash, is just above 4%.

“This is well below that of similar countries in the region. We should double that and that means we have to put in about $1 billion into the economy. That is the first strategy,” Ncube said.

He said the second strategy was legal enforcement to ensure that the Reserve Bank of Zimbabwe (RBZ) is given enough teeth, powers and legal instruments to enforce the use of domestic currency and also impose adequate penalties to dissuade those who demand payments in US dollars from doing so.

“So, I will be bringing before this august House, as part of the Finance Bill, some provisions and amendments of the RBZ Act to give more teeth to the Reserve Bank,” the Treasury boss said.

He said to ensure that the country does not re-dollarise, he would put more cash into the system, which would also strengthen the use of the local currency and build confidence around it, thereby discouraging the use of the greenback.

NewsDay